OSS - ONE STOP SHOP in the Czech Republic: a complete guide for business

OSS (One Stop Shop) is a special simplified VAT accounting regime for companies trading goods or services within the EU. In the Czech Republic

OSS (One Stop Shop) is a special simplified VAT accounting regime for companies trading goods or services within the EU. In the Czech Republic

What is an EORI number EORI (Economic Operators Registration and Identification) is a registration and identification number assigned to companies and individuals.

The concept of tax domicile in the Czech Republic Daňový domicil (tax domicile) is an official document confirming the tax residency of a natural or legal person.

Buying a car for a legal entity s.r.o. - is not just transportation, but a business tool. Owners of Czech companies s.r.o. (společnost

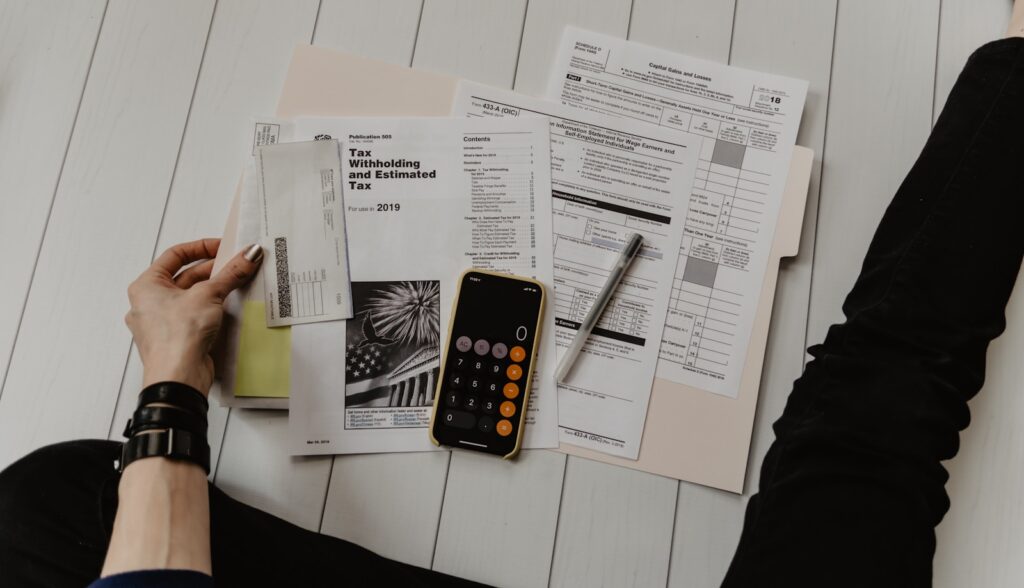

Entrepreneurs working in the Czech Republic under the OSVČ system (OSVČ / IE / FOP) are obliged to submit annual reports to the tax and insurance authorities.

Opening OSVČ in the Czech Republic - analog of sole proprietorship / FOP - a popular way to legally conduct business activities in the Czech Republic. It is an excellent

In the Czech Republic, business licenses are divided into three main categories: free (volné živnosti), craft (řemeslné živnosti) and concession (koncesované živnosti).

When registering a business in the Czech Republic, certain activities require certain qualifications, education or work experience. If the entrepreneur does not meet

In the Czech Republic, in order to run a business, you must obtain the appropriate license. Licenses fall into three main categories: free, craft and concession licenses. 1.

When working with international companies such as Meta (Facebook, Instagram), Google (ADS), Uber or Bolt taxi/food, entrepreneurs often

Doing business in the Czech Republic requires compliance with a number of mandatory reports 📑. One of the key obligations of a self-employed person (OSVČ) is to file an annual report.

The Yellow Card (Průkaz Řidiče Taxi) is a special license required for cab drivers in the Czech Republic. Without it, it is impossible to work officially

Open your company in the Czech Republic with our help Open your company in the Czech Republic and expand your opportunities in the European market.