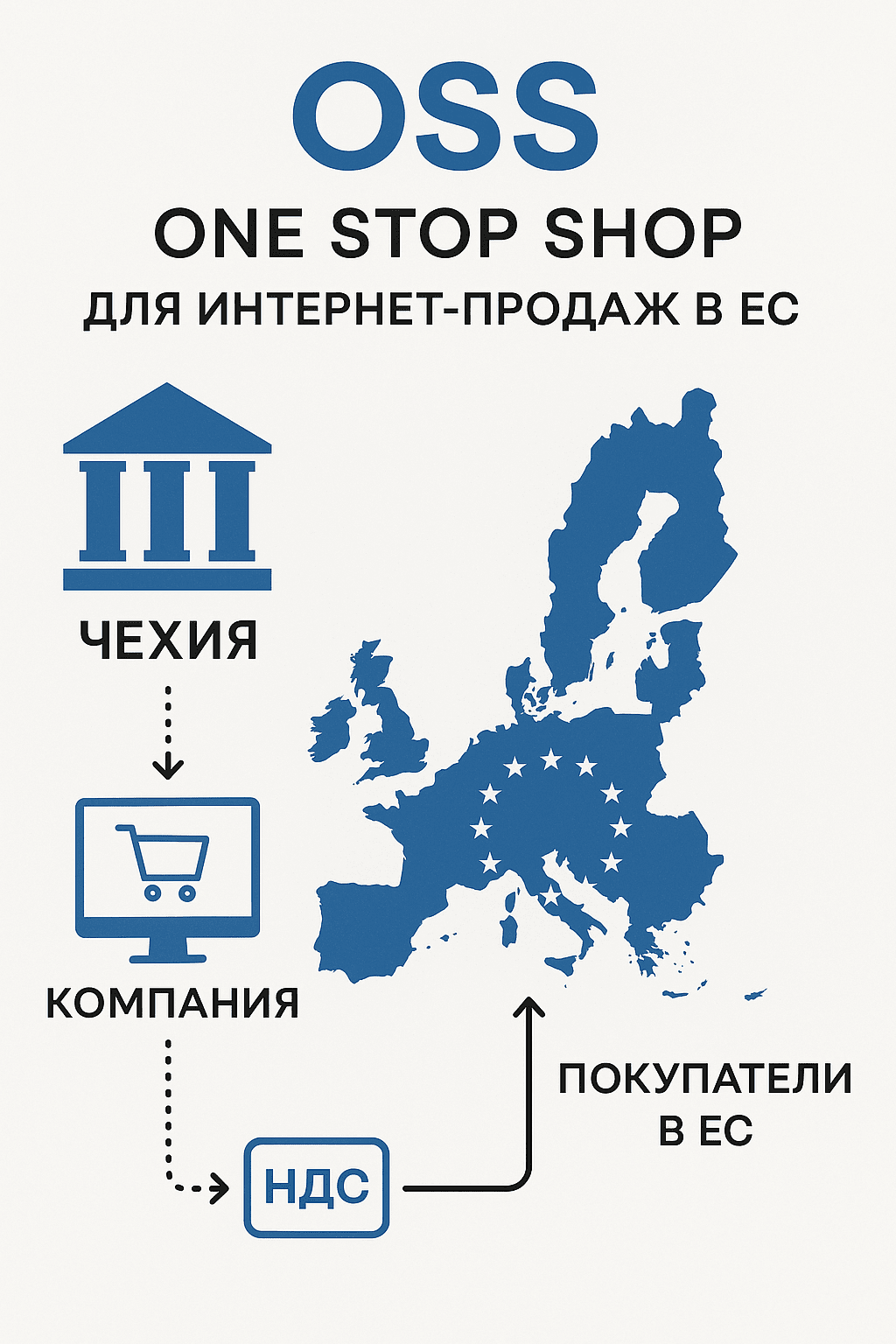

OSS (One Stop Shop) is a special simplified VAT accounting regime for companies trading goods or services within the EU. In the Czech Republic, this regime allows companies to save time, simplify tax reporting and avoid the need to register with tax authorities in other EU countries.

What is OSS?

OSS (single window regime) is a system introduced from July 1, 2021, which allows companies to report VAT on sales to EU countries through a single tax administration - in this case, the tax office in the Czech Republic.

Who OSS is suitable for

OSS mode applies if:

-

You sell goods/services to individuals in other EU countries (B2C);

-

Sales are over €10,000 per year across the EU;

-

Shipping is done from one EU country to other EU countries.

OSS not applicable to B2B sales and deliveries within the same country.

Types of OSS

-

Union OSS - for companies registered in the EU.

-

Non-Union OSS - for non-EU companies providing electronic services in the EU.

-

Import OSS (IOSS) - for distance selling of goods imported from outside the EU.

Benefits of OSS

-

One registration - no need to register for VAT in each recipient country.

-

Unified reporting - quarterly reports for all EU countries are filed through the Czech tax office.

-

Saving time and resources.

-

Less bureaucracy and fines.

How to register for OSS in the Czech Republic

-

Prepare company data (IČO, VAT number).

-

Register through portal Finanční správa ČR (https://www.mojedane.cz).

-

Select the type of mode (Union OSS or IOSS).

-

Confirm registration and keep track of report deadlines.

How reporting is done

-

Periodicity: monthly/quarterly.

-

Submission Deadline: by the end of the month following the reporting quarter.

-

Specifies: sales volume, destination countries, VAT amount for each country.

Liability and penalties

Failure to file a report on time or reporting errors may result in penalties and exclusion from the OSS regime. After exclusion, VAT registration will be required in each country of sale.

How can we help

Our accounting company in Prague offers:

-

OSS Registration;

-

Preparation and filing of quarterly reports;

-

Complete maintenance of VAT accounts under the OSS system;

-

Tax planning advice for online trading in the EU.

Want to avoid tax risks when selling to the EU? We take control of your accounting - so you can focus on growing your business. Contact